“Deprivation of assets means you have intentionally decreased your overall assets in order to reduce the amount you are charged towards the cost of care services provided by your local authority.

Your local authority must show that you knew you may need care and support in the future when you carried out this action. It is therefore an evidence based test of foresee-ability and intention.”

This quote is taken from the Age UK Factsheet – if you want to read the entire document you can access it here by clicking on the link Access Deprivation of Assets Factsheet

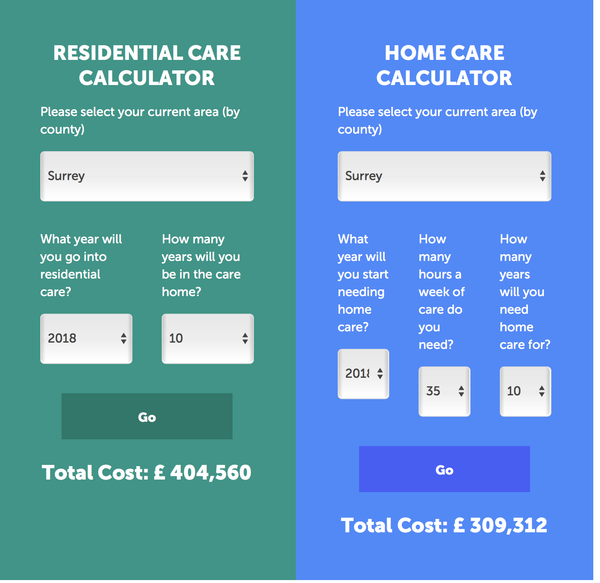

If you are concerned about the long term effect of paying care fees and how it will affect your loved ones inheritance you should be. The image below is from the UK Care Guide website they have a calculator that enables you to work out what the potential costs will be for either going into residential care or having care at home.

They estimate for residential care over 10 years in Surrey the cost would be a staggering £400,000.

Having care at home over the same period of time would set you back £300,000.

This is to be paid for with money you’ve earned and paid tax on over your life time – if you don’t have the funds then you either take the funds out of your home or you sell the home to pay the costs.

All is not lost

With careful planning done many years in advance you can give yourself the best chance of reducing your assets exposure to long term care fees – all without falling foul of estate or asset deprivation

Watch the short video below then for more information hit the Apply Today

20 thoughts on “Estate Deprivation – A word of warning…”