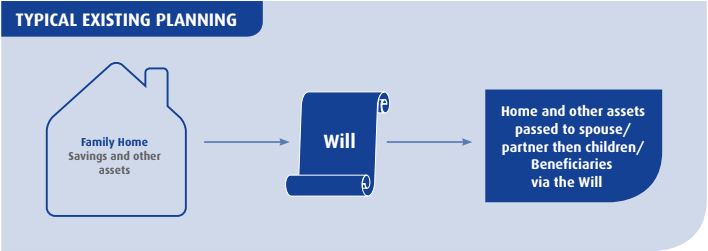

WHERE THERE IS NO WILL, OR ONLY A BASIC WILL IN PLACE, YOUR ASSETS ARE EXPOSED TO MANY AVOIDABLE RISKS ON YOUR DEATH! BY LEAVING YOUR ASSETS INTO TRUST ON DEATH THE FOLLOWING ADVANTAGES CAN BE OBTAINED.

- Divorce – If your children or chosen Beneficiaries are subject to Divorce proceedings, then a large portion of what you intended them to receive is at risk of Divorce settlements.

- Creditors or Bankruptcy – Similarly, should any of your Beneficiaries be subject to Creditor Claims/Bankruptcy then the inherited estate is fully at risk.

- Disabled Beneficiaries – Where a gift is made to a disabled Beneficiary, and the Beneficiary receives means tested benefits, then those benefits are lost until the inheritance is exhausted.

- Inheritance Tax and Further Generational IHT – If your estate is above the current Nil Rate Band then Inheritance Tax will be payable on your death. The remaining estate is likely to be directed to the Beneficiaries. This then adds to their estate and could impact on their own Inheritance Tax.

- Beneficiaries’ own future Care Costs – If the inheritance has been passed to your chosen Beneficiaries these assets could later be assessed for their own Care Costs.

THE ADVANTAGES ABOVE CAN BE GAINED BY SETTLING YOUR ASSETS INTO TRUST ON DEATH. THERE ARE ADVANTAGES THAT CAN ONLY BE GAINED BY SETTLING YOUR ASSETS INTO TRUST, WHILST YOU ARE ALIVE. FOR EXAMPLE:

LASTING POWERS OF ATTORNEY & THE COURT OF PROTECTION

Your main residence can be administered by you Trustees without the need for a separate Lasting Power of Attorney (LPA) document for property and affairs, even if you lose mental capacity. This can result in money saved and also avoid significant delays and further costs if you don’t have an LPA.

THE GOVERNMENT’S DEPARTMENT OF HEALTH STATES:

“The timing of the disposal should be taken into account when considering the purpose of the disposal. It would be unreasonable to decide that a resident has disposed of an asset in order to reduce his charge for accommodation when the disposal took place at a time when he was fit and healthy and could not have foreseen the need for a move to residential accommodation.”

If your property is settled into Trust during your lifetime, the planning should not be affected if your Will is challenged or becomes lost, destroyed or invalid.

- May save on Lasting Power of Attorney costs if the only asset is the house.

- Our Trusts ensure that if there are lineal descendants as beneficiaries, the Trust will still qualify for the RNRB.

- You make the decision of how the assets are used after your death.

The planning may assist in protecting your assets if you enter care.

Family Probate Preservation Plus Trust

The Family Probate Preservation Plus Trust is a 100% Money Back Guarantee, which runs in tandem with our Asset Protection Planning Strategy.

So what makes our PPPT different to other Asset Protection Trusts drafted by other companies?

- The 100% Money Back

- The £500 towards the cost of legal assistance in dealing with the Local Authority.

The Money Back Guarantee is provided by Countrywide Tax & Trust Corporation Ltd an established Company providing Legal Services, Probate, Professional Executor-ship and Trustee services, and is part of a group of companies providing advice in all aspects of Estate Planning and Asset Protection.

Holding the status of a Tax and Trust Corporation clearly illustrates that we are professionals within the industry. Please note that the Money Back Guarantee will only come into effect after our Asset Protection Planning Strategy has been in place for a minimum of 6 months, from the date of the transfer of the property into the Trust.

The Money Back Guarantee is a refund of the amount paid by the client for the PPPT planning. The maximum the Company will refund is £2,950 plus VAT.

This post contains only general planning and is not to be construed as advice for any personal planning. Each strategy recommended is based on individual circumstances.

To sign up for a FREE meeting with one of our advisers, click ‘Apply Today’

getasecondopinion.co.uk/contact

“It’s never too early- but it’s often too late!!!”

19 thoughts on “Family Probate Preservation Plus Trust (PPPT) to include Money Back Guarantee”